Private Co. Analysis I : Miin Cosmetics

After giving it some thought, I have decided to start a series analyzing private companies and modeling possible early-stage, growth equity, or LBO investments in these companies. I chose to begin with Miin Cosmetics because it's a local company that I really like. I also need to apologise upfront, as I believe the analysis might have been overly extensive and I would like to compact the same insights into smaller blogs in the future.

Index

Executive Summary

Founded by Lilin Yang in 2014 and incorporated in Spain, MiiN Cosmetics has been a frontrunner in the Korean beauty and skincare industry in Europe, specializing in bringing high-quality, innovative Korean beauty products to the European market. Starting with a handful of exclusive import agreements, the company has gradually expanded its partnerships to now include 30 Korean cosmetic brands, offering a portfolio of over 500 unique products.

On the financial front, MiiN Cosmetics has shown remarkable organic growth. The company is projected to attain €17M in revenue and expand its retail presence to 25 physical locations across Spain by the end of 2023, with historical EBITDA margins around 12%. This marks a significant 70% revenue growth compared to the €10M generated at the end of 2022. Achieved without external financing, the company has grown organically and currently sustains an employment base of 128 individuals. Revenue is balanced across three primary channels:

- Retail sales through their current 17 physical locations (33% of sales).

- B2B bulk sales to leading cosmetic retailers like Sephora and Douglas (33% of sales).

- Direct-to-consumer (B2C) sales via their ecommerce platform (33% of sales).

MiiN Cosmetics aims to multiply its geographical footprint and revenue streams across Europe. The company sets its sights on generating €170M in revenue and establishing over 100 physical locations by the end of 2028. MiiN Cosmetics could benefit from external financing on three key areas:

- Store Expansion: The largest upfront investment lies in the opening of flagship stores situated in premium, high-cost locations. For instance, their flagship store on Passeig de Gràcia required a €700K investment.

- Operational Gaps: The company's workforce has expanded by more than 50% in just two years. Given this rapid growth, there's likely an opportunity to enhance operational efficiency by adopting a leaner organizational structure.

- Product Development: The company has already begun expanding its own product line, sustaining the growth of its own portfolio will require upfront investment in R&D.

Company overview

Lilin Yang Born in China, was captivated by Spain from a young age after reading a novel by a Taiwanese author that portrayed the country in a compelling light. Her first trip to experience Spain first hand was in 2005. Enchanted by what she saw, Lilin decided to stay, first studying the Spanish language at the University of Alcalá and then pursuing tourism studies at the University of Salamanca. She lived in Madrid until relocating to Barcelona ten years ago.

Throughout these years, Lilin frequently traveled back to Asia, each time returning with a suitcase filled with her favorite Korean cosmetic brands that she couldn't find in Spain. Initially, these were products for her personal use, but eventually, she began to bring back items to sell to friends and acquaintances. Recognizing the untapped market, Lilin took the entrepreneurial leap and started her own import business.

In 2014, she opened her first small 25-square-meter store on Pau Claris Street. The success of this initial venture led to the opening of additional stores in Madrid and Munich. Today, Lilin has successfully built a network of 17 wholly-owned stores specializing in Korean cosmetics.

It is important to note that importing Korean cosmetics is not as simple as it seems. In the European Union, many ingredients are banned, and claims are highly regulated. Therefore, particular care must be taken when importing Korean cosmetic products to ensure that they are safe and comply with the European Cosmetics Regulation ((EC) No 1223/2009). Many Korean cosmetic brands rely on a third-party distributor to sell into the European market, highlighting the intricacies and challenges of the business.

The company has secured exclusive distribution agreements for Europe (EU) with over 30 Korean brands, encompassing a product range of more than 500 unique items. This diverse portfolio includes skincare, haircare, perfumes, and will soon be expanding into makeup. The distribution occurs through three strategically designed channels, each contributing to a business model characterized by escalating profit margins.

Retail Sales in Flagship Locations: The company operates 17 brick-and-mortar stores, serving as direct sales outlets to end customers. These stores also fulfill multiple roles.

- They function as real-world advertising platforms. Located in high-traffic, upscale areas, these visually appealing stores attract passersby and act as customer acquisition channels for future online sales.

- The long-term vision for these flagship locations includes offering premium cosmetic services.

- The physical stores provide a direct channel for communication with end consumers, facilitating ongoing product improvement through customer feedback.

B2B Sales: The company engages in bulk sales to leading cosmetic retailers like Sephora and Douglas. While this channel offers slimmer profit margins, it essentially serves as a paid customer acquisition strategy, introducing the brand to a broader audience likely to transition to the online platform over time.

Direct-to-Consumer (B2C) E-commerce: The online sales channel offers the highest profit margins and reduces inventory risk, as products can be shipped in advance from Korea to their London warehouse depending on demand.

Team

Lilin Yang has done impressive work at scaling the company without having prior operational experience and the total headcount has grown steadily to +130 employees. The rest of the Director positions in the company are occupied by:

- Isabel Cervelló, Co-managing director and COO

- Marianna Frino, Global E-Commerce Executive

- Raquel Sarradell Laguna, Head of Ecommerce & Marketing

- Marta Illa Martínez, Co-Managing Director & CFO

The organizational structure is heavily tilted towards e-commerce and marketing roles, reflecting the company's strategic focus on these critical areas. Given the fast-growth that the company experiences there are probably opportunities to increase its operational efficiency.

Market Research

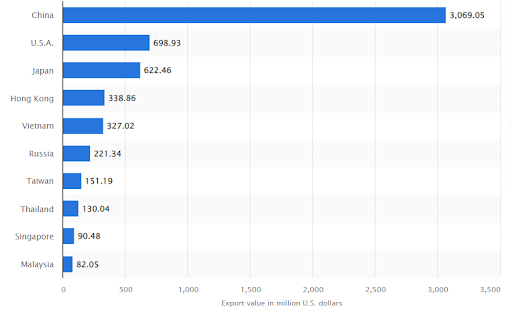

When discussing the cosmetics industry, the prominent brands from France often come to mind. However, in recent years, South Korea has emerged as the third-largest global exporter of cosmetic products, trailing only France and the United States. Commonly referred to as K-Beauty, South Korean beauty products are experiencing a significant surge in popularity. According to data from Korea's Food and Drug Safety Ministry, the market for these products expanded by 21.3% in 2021, reaching a valuation of $8.1 billion. Remarkably, the cosmetics sector has outpaced even biopharmaceuticals and smartphones—two traditional pillars of Korean exports—which generated revenues of $8.4 billion and $4.9 billion, respectively.

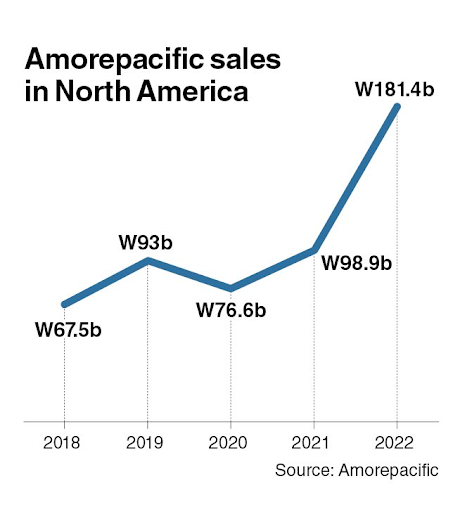

Historically, China has been the primary export market for K-Beauty, making up the majority of its total exports. However, this landscape is shifting as the Chinese market has shown signs of underperformance. As a result, major players in the Korean cosmetics industry are increasingly redirecting their focus toward the United States and Europe. The two dominant companies in the Korean cosmetics industry, with substantial export volumes, are LG Household & Health Care and Amorepacific. Both companies have market capitalizations of approximately $6 billion. In recent years, both LG Household & Health Care and Amorepacific have seen a notable decline in sales in China and their local market. However, they have experienced fast growth in the United States and the United Kingdom.

In 2022, Amorepacific, South Korea's No. 1 beauty company, strategically repositioned itself in the U.S. market. Laneige, a Amorepacific brand, became available in nearly all Sephora stores across the U.S. by 2023. In a significant move to bolster its presence in the luxury skincare segment, Amorepacific also acquired the U.S.-based Tata Harper for $130 million in September 2022, marking its second-largest acquisition deal. Amorepacific made $128 millions in its North American sales last year, an 83% percent growth from a year ago.

Its crosstown rival LG Household & Health Care is no exception. It has expanded its US business through a string of mergers and acquisitions. In recent years, the company invested a total of about $425 millions in four M&As in North America alone.

- In 2019, the company acquired US beauty firm the Avon Co. for $102 millions, as well as the Asian and North American business rights for US skincare brand Physiogel for $134 millions in 2020.

- In 2021, it acquired a 56 percent stake in US hair care brand Boinca for $81 millions, along with a 65 percent stake in US cosmetics brand the Creme Shop a year later for $107 millions.

As of May 2023, both Amorepacific and LG Household & Health Care have relatively limited market presence in Europe. To address this, Amorepacific recently launched Laneige, its flagship global skincare brand, in the United Kingdom and the Middle East, following its successful introduction in North America. The move is part of the company's ongoing international expansion strategy, aimed at reducing its reliance on the Korean and Chinese markets. The next likely target market for expansion is Germany. However, entering the European Union presents its own set of challenges for an outsider, notably the stricter regulations on cosmetic ingredients.

The European Union, and France in particular, is home to some of the world's largest cosmetics companies, including giants like L'Oréal, Estée Lauder, and LVMH. Interestingly, these industry leaders have been recently acquiring Korean brands in a strategic acquisition spree. Some notable examples include:

LVMH:

- In 2016, LVMH invested $50 million to acquire approximately 7% of Clio Cosmetics, thereby valuing the company at around $700 million.

- In 2019, Parfums Christian Dior, a subsidiary of LVMH, purchased a manufacturing facility from South Korean cosmetics giant AmorePacific.

Estée Lauder:

- In 2019, Estée Lauder acquired the remaining two-thirds of Have & Be Co., the South Korean parent company of Dr. Jart+ cosmetics, for roughly $1.1 billion. This marked the company's first acquisition of an Asian beauty brand.

L’Oréal:

- In 2018, L'Oréal finalized the acquisition of Stylenanda, a South Korean company specializing in lifestyle, makeup, and fashion. The deal was valued at $371.6 million, approximately 3x times Stylenanda's annual revenue.

As of March 2023, L'Oréal and LVMH, along with other leading global beauty brands, were reportedly vying for a controlling stake in South Korea's Able C&C. This cosmetics company is currently owned by IMM Private Equity. According to available reports, the deal is estimated to be worth at least $70 million.

The past three years have also seen a rise in the number of e-commerce companies distributing Korean cosmetics throughout Europe, signaling growing consumer interest in the sector. However, these smaller entities lag significantly behind Miin Cosmetics in terms of brand awareness and physical presence. Additionally, they trail considerably in commercial traction, given that Miin Cosmetics has had a 10-year head start in the market. Therefore, they are not well-positioned to capitalize on upcoming market opportunities.

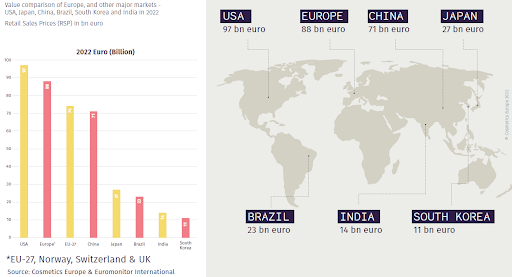

The European cosmetics industry actually surpasses its Chinese counterpart in size, with a total market value of $88 billion. The five largest markets within Europe are as follows: Germany holds the top spot with a market size of €14.3 billion, followed by France at €12.8 billion, Italy at €11.5 billion, and the UK at €10.5 billion, Spain holds the 5th position with €9.25 billion.

Spain actually stands out as the fastest-growing market among the top five European countries, experiencing a 10.6% YoY growth in 2021-2022. Additionally, Spain is the headquarters for Puig, one of the biggest competitors to the French cosmetic giants.

Considering the substantial size of the European cosmetics market, even a relatively modest penetration rate of 5% for Korean cosmetics could translate into a revenue opportunity exceeding $5 billion in the coming years which is mostly untapped.

Market Positioning

There is a significant distinction between some of the Korean brands recently acquired by major players and those that could potentially compete with Miin Cosmetics. For instance, acquisitions like Stylenanda were primarily aimed at acquiring a range of products that can then be distributed exclusively in Europe. On the other hand, brands like Dr. Jart+ have established e-commerce platforms for European distribution, particularly in the UK, and also partner with third-party retailers like Sephora. So e-commerce platforms like Dr- Jart+ can be used also as a distribution channel for other brands.

In any case, brands like Dr. Jart+ (owned by L'Oréal) are likely to compete directly with Miin Cosmetics, as both cater to similar customer demographics. Key differences include Dr. Jart+'s slight price premium over Miin Cosmetics and a more specialized, limited product range compared to Miin's broader offerings.

It's worth noting that Miin Cosmetics is primarily a retailer and has only recently begun to launch its own products. This gives them a strategic advantage in generating traffic for both their physical and online platforms, thanks to a more extensive product offering.

Miin Cosmetics is well-positioned to become the go-to retailer for Asian cosmetic brands. Unlike Sephora, Miin Cosmetics adopts a digital-first approach from the beginning and possesses strong expertise in e-commerce. Leveraging its leadership in retailing Korean and other Asian brands, Miin will be uniquely situated to successfully launch its own product line.

Exit Comparables

The cosmetics industry is among the most active sectors in terms of mergers and acquisitions (M&A), attracting both major corporations and specialized private equity firms. However, for the purpose of this analysis, we will narrow our focus to a select group of companies that have experienced a trajectory similar to that of Miin Cosmetics.

One of the most notable and recent examples is the acquisition of the 'low-cost' cosmetics brand, The Ordinary, by Estée Lauder in 2021. The $1 billion deal aimed at acquiring a majority stake in the company, reflecting a total enterprise value of approximately $2.2 billion USD. Since Estée Lauder's initial investment in The Ordinary in June 2017, the brand has experienced rapid growth, reporting net sales of approximately $460 million USD for the 12 months ending on January 31, 2021. Estée Lauder plans to assume full ownership of the brand within the next three years.

While there are some similarities between The Ordinary and Miin Cosmetics, key differences exist. Unlike The Ordinary, which is a low-cost brand, Miin Cosmetics is a retailer specializing in medium-priced products and has only recently entered the market with its own medium-priced brands. Additionally, while The Ordinary has primarily focused on e-commerce and recently expanded into retail partnerships with stores like Sephora, it has not pursued flagship stores like Miin Cosmetics.

As of 2021, Estée Lauder's $1 billion investment in The Ordinary valued the company at $2.2 billion, representing a multiple of approximately 4.8x times its revenue at the time of the acquisition, which was $460 million. While specific margin information is not readily available in public records, some data on the company's UK branch (operating under the name Deciem UK) provides insight. According to these records, Deciem UK reported revenue of approximately £108.2 million in 2020 and a net profit after tax of £8.9 million. From this, we can estimate that the company had EBITDA margins in the vicinity of 12%, so the company was valued at about 40x times EBITDA at the time of the acquisition.

As we will explore in greater detail in the Financials section, Miin Cosmetics currently has EBITDA margins comparable to those of The Ordinary. However, Miin Cosmetics is showing an upward trend in the margins.

Other relevant acquisitions in the space:

- In 2022, the South Korean giant LG H&H bought The Créme Shop, in its efforts to enter the US market. The Créme Shop is an e-commerce based business that sells their own brands of South Korean cosmetics. Their products are similarly priced to those of Miin Cosmetics and reported a revenue of around $10 million at the time of the acquisition. The company was acquired for $120 million or about 12x revenues.

- As previously noted, in 2022, South Korean conglomerate Amorepacific entered into a definitive agreement to acquire Tata Harper for $124 million, as part of its strategy to strengthen its presence in the U.S. market.

- In 2021, Amorepacific acquired a 38.4% minority stake in the South Korean brand Cosrx for $153 million - Cosrx is one of the standout brands distributed through Miin Cosmetics. Despite being based in Korea, Cosrx generates more than 80% of its sales from international markets, highlighting the need for major Korean companies to diversify into new markets. The investment valued Cosrx at approximately $400 million. As of the end of 2020, the company reported $60 million in revenue and $12.5 million in EBITDA, equating to a 20% EBITDA margin. Consequently, the valuation metrics for Cosrx stood at 6.6x times revenue and 32x times EBITDA.

On one hand, the high multiples paid for European and American small cosmetic brands by Korean players reflect their necessity to diversify away from their typical markets and gain market share in Europe and the US. On the other hand, the high multiples paid for Korean brands by the European big cosmetics players, reflects the new trend of k-beauty in the western markets.

Financials

Before delving into the specifics of the investment, it's worth noting that a full-scale Leveraged Buyout (LBO) has been modeled for the sake of simplicity. However, it is unlikely that this is the most suitable investment structure in this case. Given the company's rapid growth trajectory, and the significant opportunities available to unlock greater value—such as the development of its own product line—it would be essential that the founder retains the majority ownership. This approach would be crucial in realizing the full value potential of the enterprise. Additionally, it also seems unlikely that the founder would be willing to cede a majority stake at this point in time. Therefore, a more sensible approach would be a minority-stake LBO, acquiring no more than 49% of the company or a simpler growth investment.

Assumptions

Investment Details:

- Purchase of Miin Cosmetics at a 15.0x EBITDA multiple, based on the forecast financials for the end of 2023.

- The acquisition will be financed with a debt-to-equity ratio of 60:40.

- An assumed weighted average interest rate of 12% will apply to the debt.

Financial Projections:

- Miin Cosmetics is projected to reach €170 million in sales revenue by the end of Year 5 (2028), representing a 58.49% Year-over-Year (YoY) growth over 5 years.

- The historical YoY growth for Miin Cosmetics between 2022-2023 was 70%, achieved organically without external financing.

Operational Strategies:

- Miin Cosmetics could grow its EBITDA margin from 12% to 20% over the next 5 years. This is expected to result from the development of its own brand of products and other levers, with an assumed annual increase of 1.6% in EBITDA margin of the upside case and no increase in the downside case.

- To reach the target of €170 million in revenue, Miin Cosmetics plans to open 100 physical locations across Europe. This will entail opening an additional 75 stores, or approximately 15 new stores per year.

Working Capital:

- Miin Cosmetics operates with a centralized shipping model from a warehouse in London and imports its products from South Korea, factors that likely contribute to significant working capital requirements. Therefore, a working capital assumption of 5% as a percentage of revenues will be used.

Tax and Depreciation:

- A tax rate of 25% is assumed.

- Given the nature of the business, we will assume that there are no depreciation or amortization expenses.

Exit Strategy:

- The exit strategy involves selling the company to a strategic player modeled with the financials at the end of Year 5.

- The exit multiple is expected to be between 15x and 30x EBITDA.

- All outstanding debt is planned to be paid down at the moment of the sale at the end of Year 5.

Scenarios:

- Upside Scenario: 60% YoY growth in revenues and a 1.6% annual increase in EBITDA margins.

- Base Case: 40% YoY growth in revenues and a 0.8% annual increase in EBITDA margins.

- Downside Scenario: 20% YoY growth in revenues, with EBITDA margins remaining constant.

Model

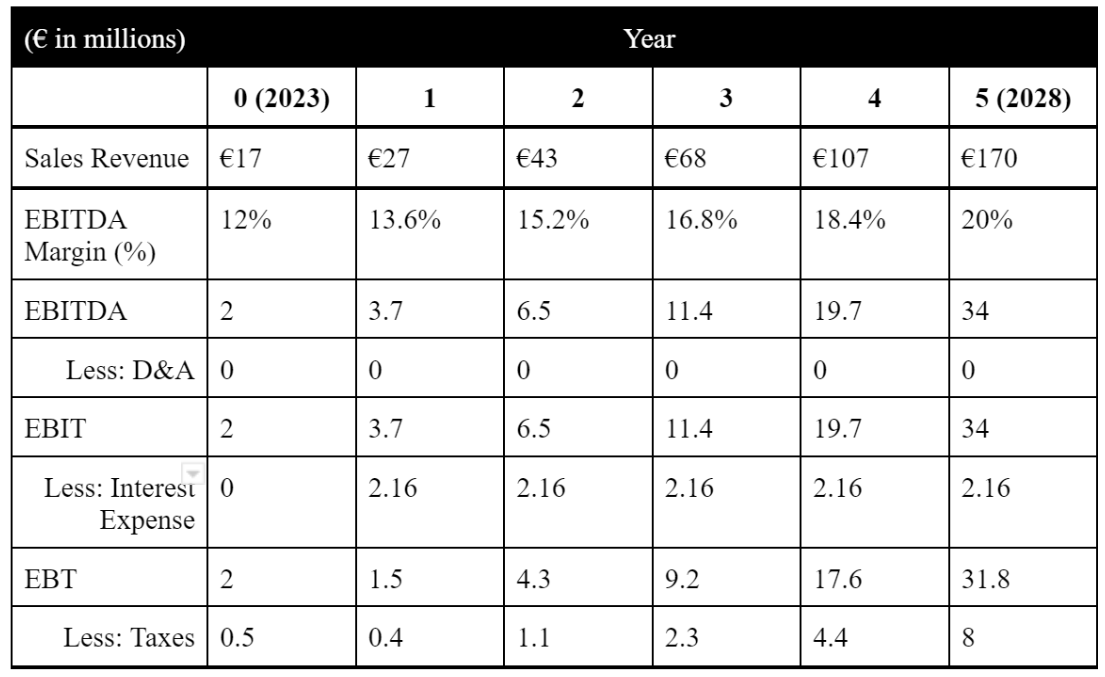

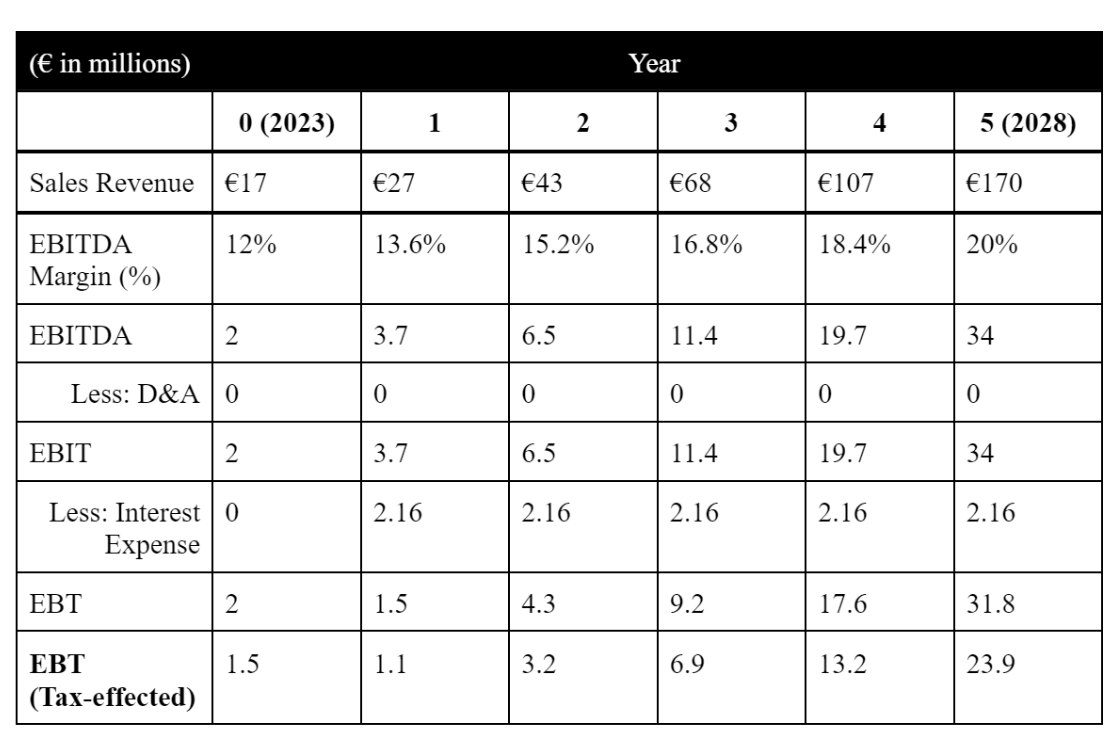

Only the upside scenario will be calculated end-to-end to simplify the analysis.

Valuation of Miin Cosmetics

Valuation = 15 × 2 million EBITDA (EOY 2023) = €30 million.

Using a 15.0x entry multiple, the price paid by multiplying Year 0 EBITDA (2023) of €2 million (which represents a 12% EBITDA margin on €17 million in revenue) multiplied by 15 results in a purchase price of €30 million.

Debt and Equity funding amounts needed

Assuming a debt to equity ratio of 60:40 for the purchase price and assuming no previous debt.

Debt portion = 60% × €30 million, or €18 million.

Equity portion = 40% × €30 million, or €12 million.

Income Statement

An €18 million debt at a 12% interest rate results in an annual interest expense of €2.16 million. As outlined in our assumptions, all outstanding debt is scheduled for repayment at the conclusion of Year 5, coinciding with the planned exit of the company. Additionally, we are assuming a tax rate of 25%, as previously mentioned.

It's important to note that we are assuming neither Depreciation and Amortization (D&A) expenses nor debt payments for Year 0, as the investment in the company is slated for the end of year 0. For the upside case, we are assuming a constant annual increase in the company's profit margins of 1.6%.

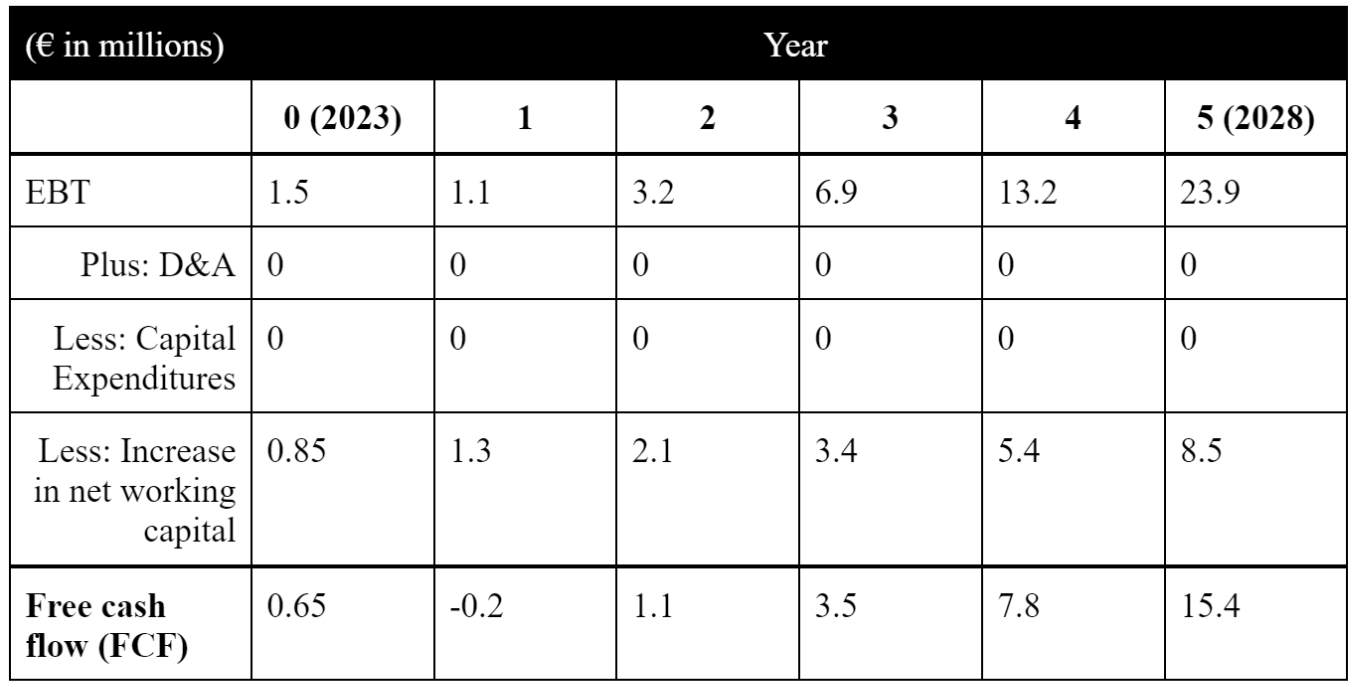

Cumulative Levered Free Cash Flow (FCF)

In this scenario, the cumulative cash flow from Year 1 to Year 5 would amount to €27.6 million. Notably, Year 1 would experience negative cash flow, despite the company remaining profitable.

As previously noted, our assumptions include a working capital that accounts for 5% of total revenues. This figure could be higher, as detailed in the risks section at the end of this report. We have opted not to include Depreciation and Amortization (D&A) expenses, based on the assumption that the company may not need to open 100 flagship stores.

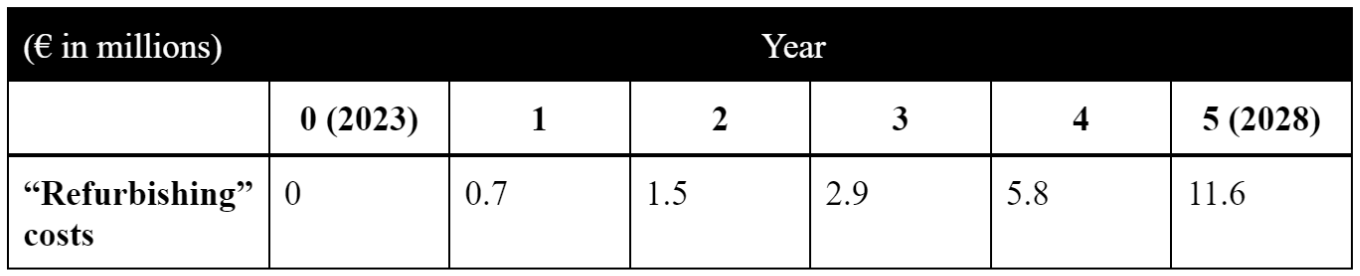

However, if we were to include the initial investment required for refurbishing and setting up leased physical locations, particularly those in premium areas. Opening up 100 new flagship stores over the next five years would entail significant costs. Based on a conservative estimate of €300,000 per store, and considering that the company aims to have 25 stores by the end of 2023, an additional 75 stores would need to be established at a rate of approximately 15 per year for the subsequent five years. This would amount to a total expenditure of €22.5 million, or roughly €4.5 million annually. While substantial, these costs are not expected to be recurring, as the need for physical stores is likely to plateau or even decline once the company has achieved sufficient brand awareness.

Including these initial store setup costs in the cumulative cash flow would result in negative cash flow for the first three years. This would complicate debt repayment, although it would remain possible. If we were to distribute these €22.5 million in refurbishing costs over a span of five years, with the amount doubling each year from Year 1 to Year 5, the allocation would be as follows.

In any case, this change does not substantially impact the company's exit prospects but does increase the risk associated with debt repayment as free cash flow creation will be much lower. It's also evident that two primary levers for enhancing the company's cash flow would be to optimize working capital and to efficiently allocate investments in new flagship stores only if needed.

Ending Purchase Price (Exit Value) and Returns

- Total Enterprise Value (TEV) at Exit: As we mentioned, the range of EBITDA multiples for similar companies has been 15-30x. Assuming that the company gets acquired on a multiple of revenues oF Year 5, this would mean: €34 million Year 6 EBITDA × 15x/30x multiple = €510-1,020 million Enterprise Value at Exit. We will assume the lower end of the €510 million going forward.

- Net Debt at Exit: €18 million in Beginning Debt – €27.6 million in Cumulative FCF = €9.6 million in cash, the debt is fully paid with the cumulative cash flow.

- Ending Equity Value (EV): €510 Exit TEV + €9.6 million Ending Cash = €520 million Ending EV.

- Multiple-of-Money (MoM): €520 million Ending EV ÷ €12 million Beginning EV = 43x MoM.

- IRR based on the MoM multiple: 112% IRR

The calculated IRR is exceptionally high, likely influenced by the simplifying assumptions we've incorporated into our model. Additionally, it's worth noting that this represents the most optimistic scenario for the company. Nevertheless, even when considering these factors, the resulting IRR could afford a substantial margin of safety and still prove to be highly attractive.

Investment Recommendation

The recommendation to invest in Miin Cosmetics—whether through full or partial acquisition—is strongly positive, given an exceptionally attractive IRR of 112% in the upside scenario. Beyond the financials, there are three key qualitative factors that enhance the investment's appeal:

- Organic Growth and Leadership: The company has been expanding rapidly through organic growth, without requiring external capital. Additionally, the founding entrepreneur has showcased not only exceptional management skills but also high levels of ambition.

- Market Dynamics: The Korean cosmetics sector is poised for significant growth in Europe in the coming years. Major industry players like Amorepacific and LG Household & Health Care are actively exploring acquisition opportunities to enter the U.S. and European markets.

- Strategic Positioning: Miin Cosmetics holds a first-mover advantage in the European market, positioning it well to capitalize on emerging opportunities.

Moreover, the company stands to benefit from investor expertise in managing working capital and capital expenditures. This could further enhance free cash flow yields and create attractive exit options

Risks and Mitigations

Risks associated with the investment include potentially higher working capital needs than estimated, more capital-intensive investments for opening new flagship stores, and unaccounted-for R&D expenses. Despite these risks, the high rate of return on the investment serves as a substantial margin of safety, mitigating these concerns.

The risk of a recession leading to reduced consumer discretionary spending is also a concern. However, the company has been growing organically, suggesting a lean operational structure that could be more resilient to economic downturns. Additionally, there's the potential risk of increased shipping costs from Korea.