Public Co. Analysis I : Hyperfine Inc (HYPR)

Hypothesis: Can Hyperfine (HYPR) grow it's valuation 10x in the next 10 years (CAGR: 25.9%) ?

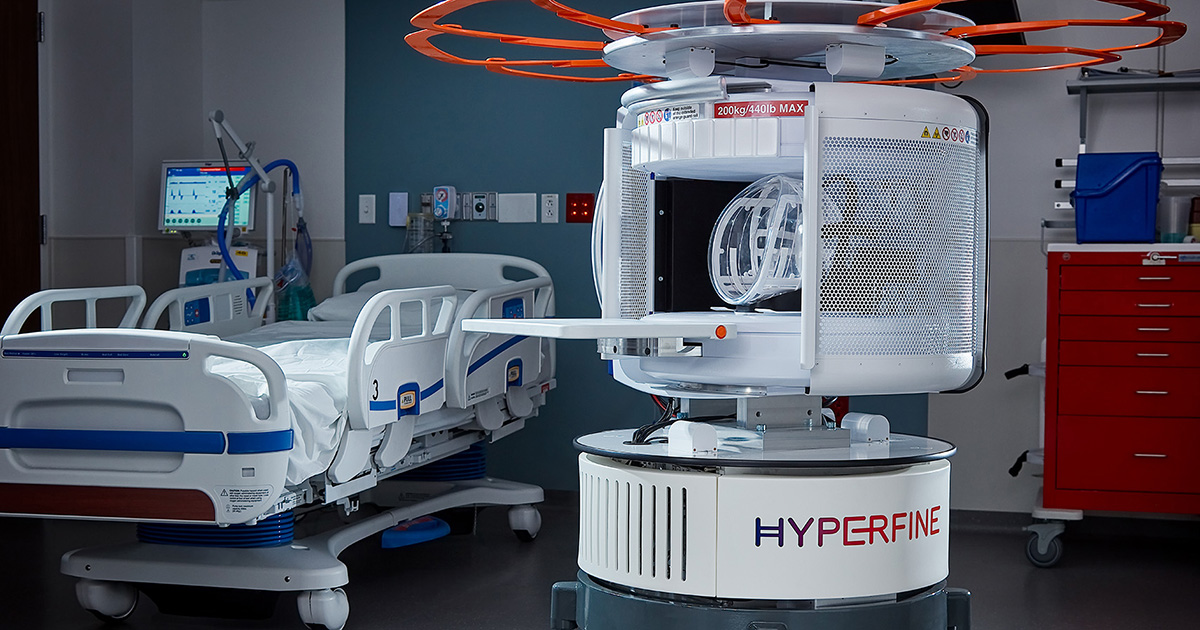

Hyperfine is a United States based public company manufacturing and selling portable low-field MRI systems. MRI scanners create images of the body using a large magnet and radio waves in order to help with the diagnosis/monitoring of diseases ranging from cancer, autoinmune diseases or musculoskeletal conditions. Most of the market has been historically dominated by high-field MRI scanners which are more bulky and expensive but offer more detailed images than low-field MRI, which in contrast (pardon the joke) offers more portability and a cheaper price in exchange for lower quality of the images.

To assess if Hyperfine can grow 10x in the coming 10 years, I am going to separate my analysis in 4 different question:

- What does Hyperfine need to be valued at 10x the current valuation?

- What needs to happen for Hyperfine to get there? (i.e. milestones)

- Assessment of the broader market, is it realistic to get to those milestones?

- Is it realistic for Hyperfine to get there? Does the company have all the tools to get there and what are the possible risks.

1. What does Hyperfine need to be valued at 10x the current valuation?

As of June 17, 2023, Hyperfine is valued at approximately $150M, which is significantly lower than the price they achieved during their IPO through a Special Purpose Acquisition Company (SPAC). This is not surprising as many SPAC's ended up with very poor returns for investors and very nice fees for sponsors but I won't start discussing the legitimacy of SPAC's in this post. In any case, in order to achieve desired return on investment, Hyperfine would need to achieve a $1.5B valuation in the next 10 years. To give it another spin (excuse the s-pun), I am going to add a 50% margin of safety to that and assume $2.25B valuation for a 10x return on our initial statement.

To continue with our conservative analysis, we will assume that Hyperfine will be value af 5x it's gross revenue in the future, meaning that to achieve a $2.25B valuation, the company will need about $450M in gross revenue. Given that the current gross margins of the company are around 45% and assuming that will be the case in the future, Hyperfine will need about $1B in revenue to be valued at $2.25B - this is going to be our core milestone.

2. What needs to happen for Hyperfine to get there?

To put the current situation of Hyperfine in perspective, they expect to reach about $12M in revenue in 2023, which is about 2x the revenues from 2022. If we assume that Hyperfine will be able to continue doubling it's revenue YoY for the next 7 years, it should reach the $1B revenue mark at some point in 2030. This is certainly within our 10 year mark but it is also bold to assume that the company will be able to double it's revenue each year for the next 7 years. In order to put our forecast in context, we need to look at the total size of the opportunity to assess if there will be enough demand to support the sales projections.

3. Assessment of the broader market, is it realistic to get to those milestones?

Focusing first in the United States, there are currently about 13k MRI systems in the US and the average price ranges from $1-3M which equates to an approximate market size of $26B. However, these are mostly high-field systems, while Hyperfine is selling low-field systems for point of care diagnosis/monitoring with the starting use case of monitoring intensive care unit (ICU) patients for stroke.

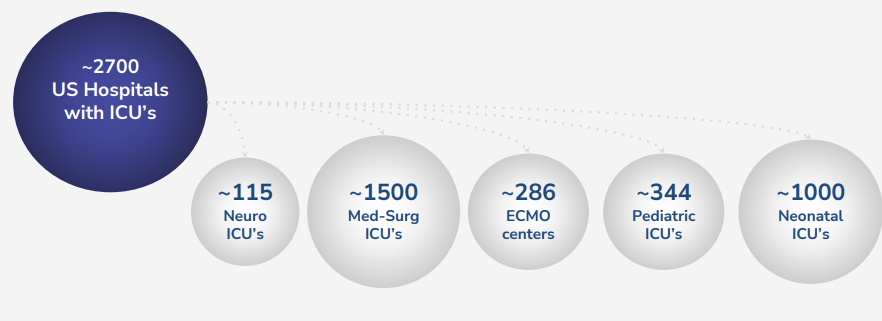

The initial TAM for Hyperfine consists of all the 2700 ICU's in the US. As mentioned, low-field systems are cheaper, Hyperfine is selling their systems at about $250,000. Assuming that each ICU can fit 2 different systems, we can calculate the TAM of Hyperfine by: 2 systems per ICU x 2,700 ICU's x $250,000 per machine = $1.35B. Therefore, Hyperfine has an initial TAM of $1.35B.

However, we cannot expect that Hyperfine will capture 100% of the market. For Hyperfine to achieve $1B in revenue they will need to tackle the bigger opportunity of neurodegenerative diseases. MRI is already the gold standard in the diagnosis and monitoring of neurodegenerative diseases, it's use in this category is only expected to increase with demographics and new drugs coming into the market that will require tighter monitoring of patients.

4. Is it realistic for Hyperfine to get there? Does the company have all the tools to get there and what are the possible risks.

To finalize the analysis we need to look into the current capabilities of Hyperfine, as well as, the challenges they will have to face. The most important factor to consider is that Hyperfine is currently not profitable to they depend on external capital to continue operating. Looking at their balance sheet they should have around $150M in cash by end of 2023, which given their current burnrate of around $50M per year should take them atleast to the end of 2025. If by the end of 2025 the company is not profitable they will need to raise more capital.

Another important aspect is competition, even though Hyperfine seems to be ahead of competition there is a number of privately backed companies developing directly or indirectly competing systems. However, these are still private companies that given the current venture ecosystem will struggle to get to market. The most likely scenario is that if Hyperfine succeds in becoming profitable, they will be able to acquire some of these incumbents before they get to market.

Summary

Hyperfine is well positioned to take advantge of market trends that will demand more capacity for medical imaging at a better price. Furthermore, some of the disadvantges of low-field vs. high-field MRI like image quality will possibly be reduced by using software to enhance image quality and support with diagnosis. Therefore, Hyperfine could indeed achieve $1B in revenues in the next 10 years, multiplying it's valuation by 10x.